Overview

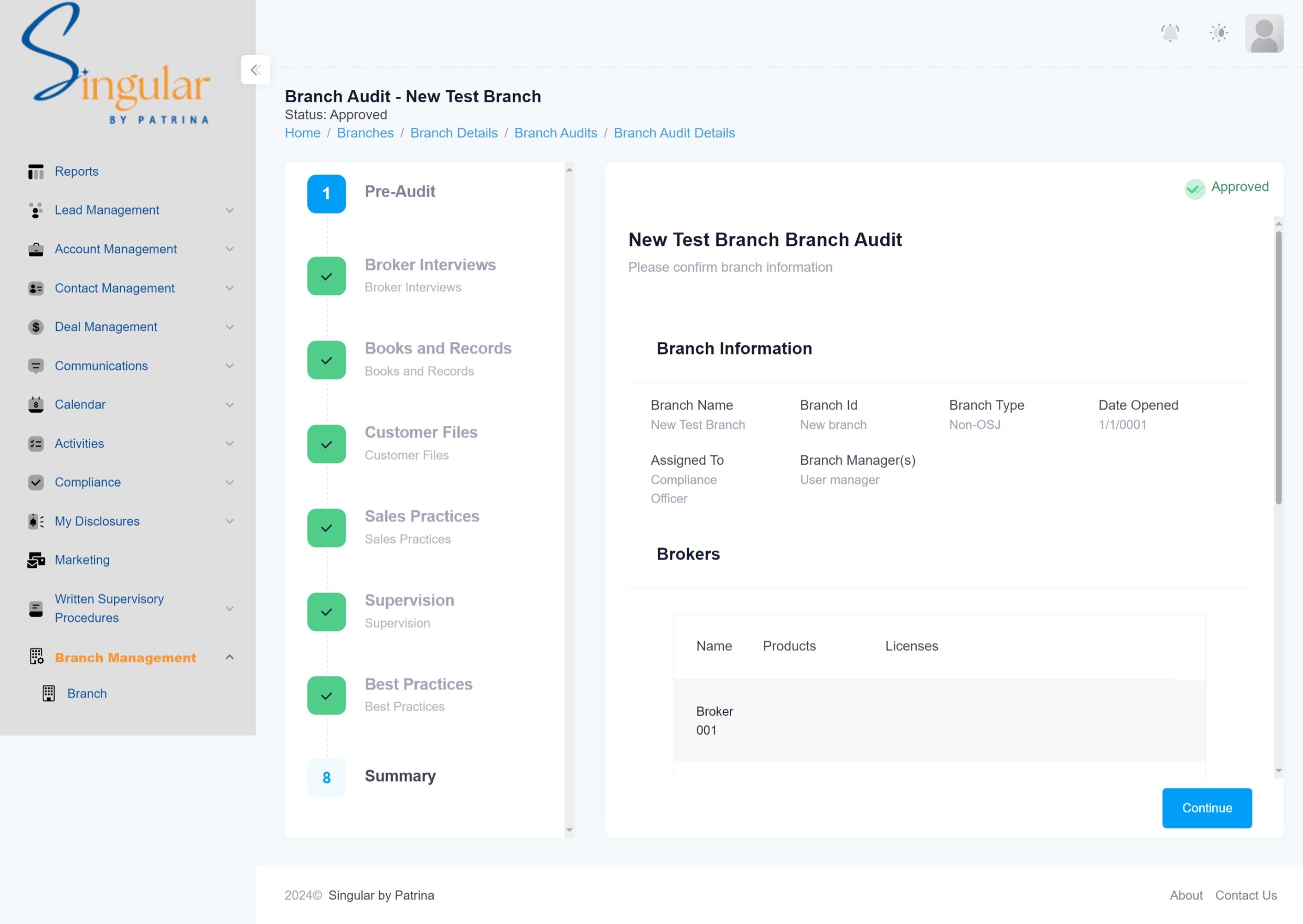

As part of Singular’s comprehensive compliance solutions, our OSJ and Branch Office audit tool is a powerful platform designed to streamline and enhance your internal auditing processes for FINRA compliance. With advanced workflow capabilities, Singular’s OSJ and Branch audit solution ensures efficiency and accuracy, guiding you seamlessly from pre-audit preparation to post-audit review.

By centralizing audit management, your team can easily schedule, conduct, and track audits, ensuring thorough documentation and consistent adherence to regulatory standards. Singular by Patrina helps ensure regulatory compliance and empowers your organization to identify operational gaps, mitigate risks, and implement improvements that strengthen your overall compliance framework.

Key Features

Audit and Compliance Management

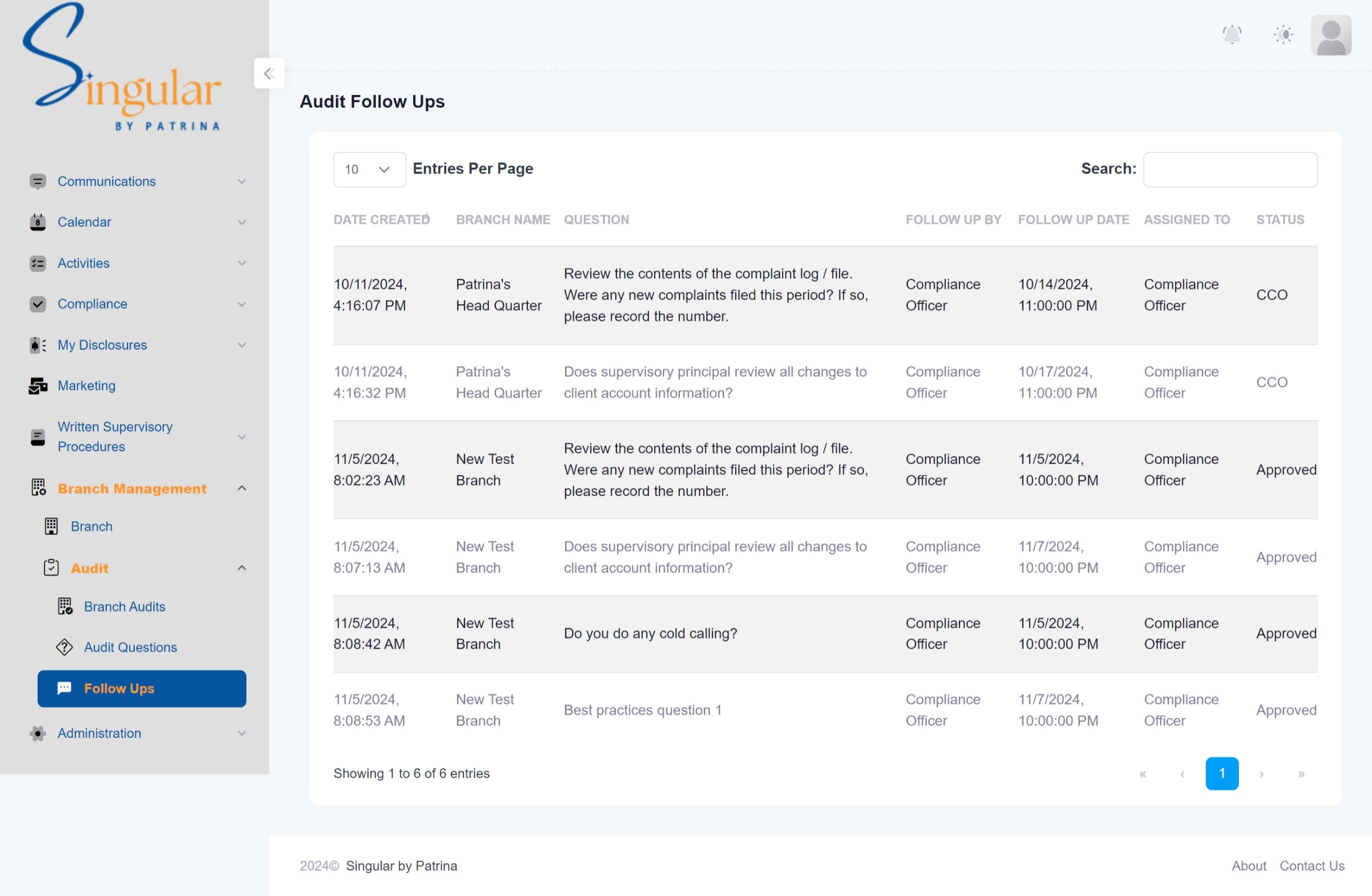

Streamline audits with real-time user activity and changes tracking, automated compliance calendar, and proactive risk management. Attach supporting documents and use an intuitive interface for efficient compliance management.

Data Driven Insight

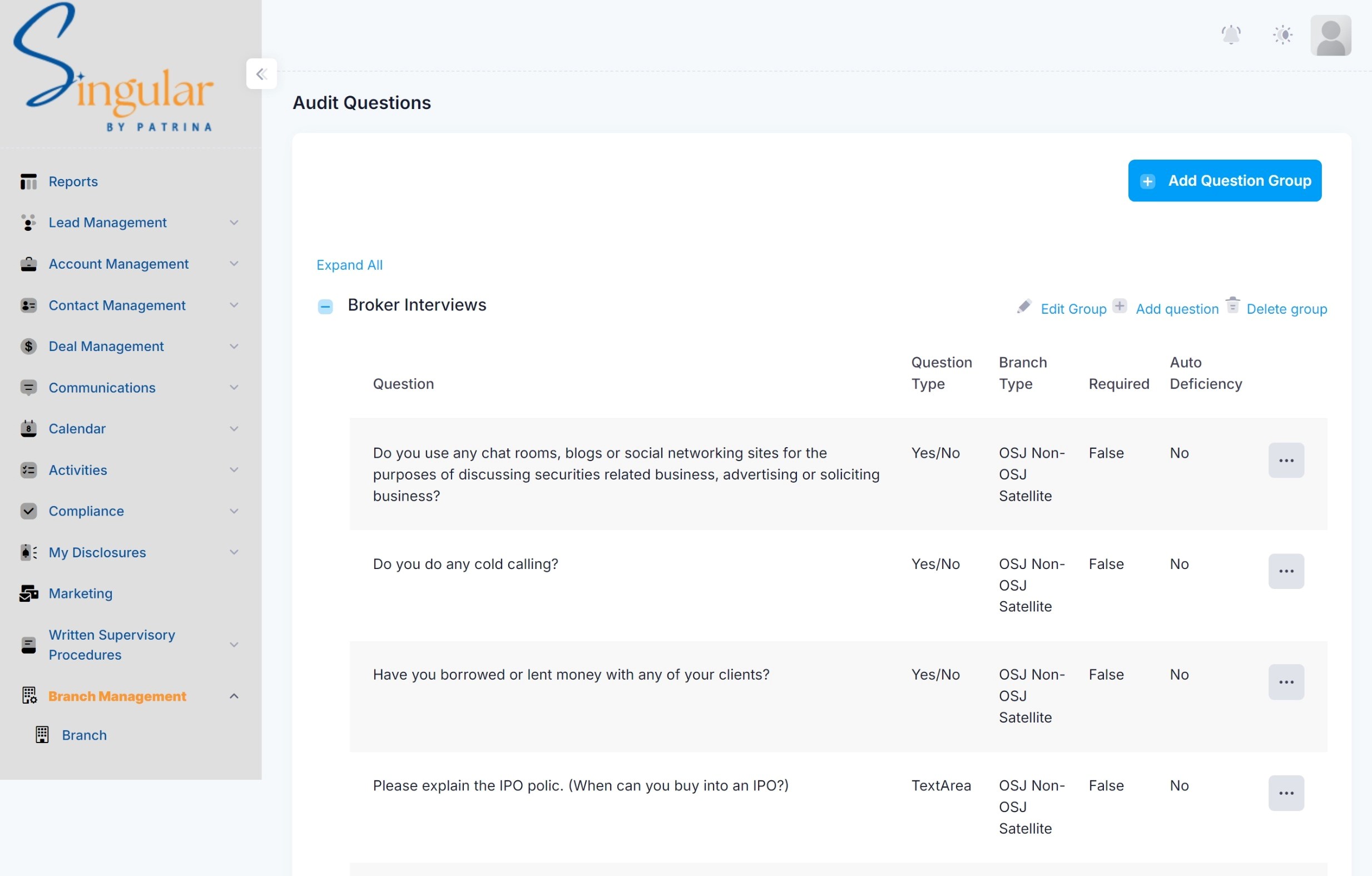

Maintain a customizable database of audit questions, assess risks using our scoring system, and develop mitigation plans. Quickly generate post-audit findings letters for efficient documentation.

User-Friendly Interface

Navigate your audit effortlessly with an intuitive design. Prepare faster and access comprehensive training and ongoing support from our dedicated team.

Benefits

- Time-Saving: Manual audits can be time-consuming. Singular’s Branch Audit tools automate several audit tasks, allowing your team to focus on analysis rather than data entry.

- Standardization: By following your firm’s pre-established templates and procedures, you ensured compliance with your FINRA/SEC audits

- Real-Time Data: Your compliance team can access real-time data from all branches, leading to faster audits and quicker decision-making.

- Standardized Processes: Singular’s tools enforce a consistent auditing process across branches, ensuring uniformity and reducing discrepancies between audits.

Use Cases

- Financial Services: Ensure every branch adheres to stringent regulations and internal policies, including critical compliance frameworks like AML and KYC requirements. This involves continuous employee training, regular internal audits, and implementing technology to flag suspicious activities in real time. By integrating advanced compliance software, branches can minimize manual errors, enhance fraud detection, and ensure timely reporting to regulatory bodies.

- Corporate Level: Streamline and automate the auditing processes across multiple branches or locations using centralized compliance platforms. Automation tools can reduce redundancies, improve data accuracy, and update real-time compliance status. Leveraging analytics can also identify potential risks and anomalies, ensuring proactive risk management. This approach enhances regulatory compliance and boosts operational efficiency by reducing time spent on manual reviews and improving communication between branches and the corporate headquarters.

Why Trust Patrina Compliance with your data? Just ask our clients.

We couldn’t be the leader in regulatory compliance innovation without the trust of our clients. Compliance professionals like you.

We chose Patrina because the solutions our previous archive partner provided did not meet our growing needs... Patrina's service is impeccable.

I recommend Patrina to my state- and SEC-registered RIA clients because their email archiving system is equal to any in the market, and better yet, it's less expensive than any of the others. Patrina offers a comprehensive compliance suite so that my SEC and state RIAs can inexpensively capture everything in one portal...