One platform to build and maintain a culture of compliance to the FINRA Rule 2210

Speed to market matters. So what if you could reduce the time it takes to create, execute, approve, and distribute all your digital and conventional marketing communications:

Your ads?

Your brochures?

Your whitepapers?

Your direct mail outreach?

FINRA, and various state, federal, and other regulatory agencies’ requirements can slow the process of compliantly managing your firm’s advertising, public relations, and marketing communications processes.

Patrina’s Marketing Materials Module speeds up your compliance process around FINRA marketing rules

One of 8 powerful modules built on the industry’s easiest-to-use interface, Patrina’s Marketing Materials Module streamlines the regulator-required approval process so you can move your marketing materials out of the concept phase and into the hands of your employees, clients, prospects, and referral sources.

Whether you are a one-branch shop or a multinational, Patrina’s Marketing Materials Module enables your marketing team to efficiently:

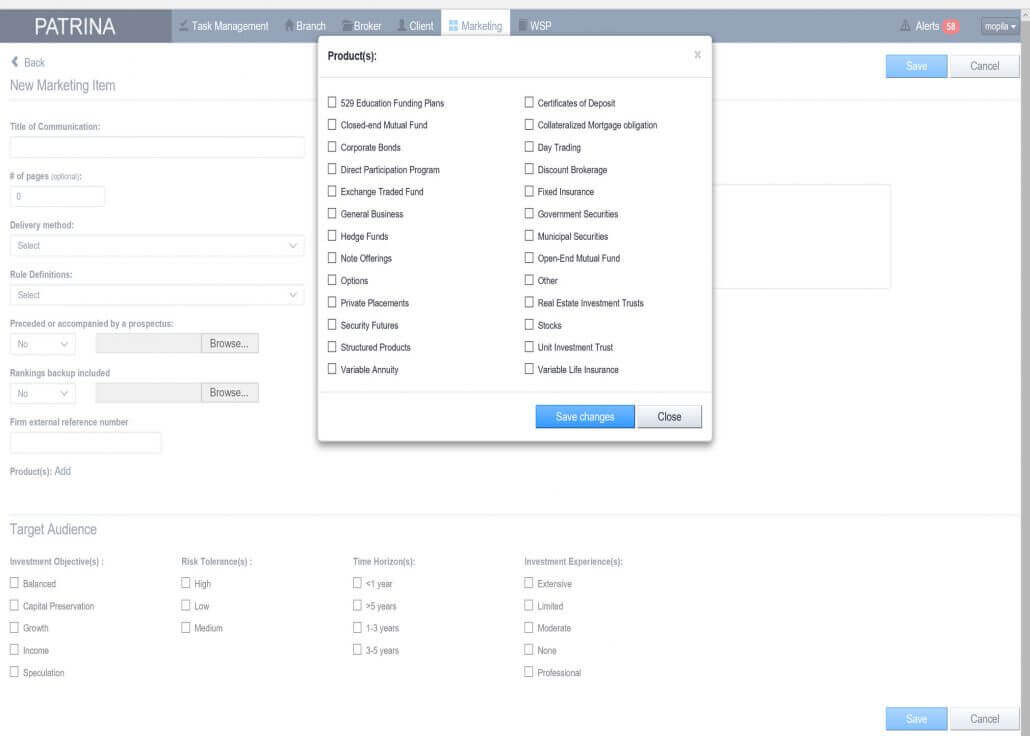

- Submit marketing material for review and approval;

- Choose appropriate delivery methods ;

- Assign FINRA rules definitions; and

- Target audiences based on investment objective, time horizon, risk tolerance, and investment experience.

- View and comment on content;

- Approve or reject material;

- Create a “first use date” and “sunset date;” and

- Add approved material to a searchable database of approved marketing material.

- Access approved marketing pieces that have not yet reached their sunset dates;

- Circulate targeted marketing pieces approved for a specific segment of investors; and

- Submit planned email, social media, or other public communications for pre-approval.

Craft the perfect message and ensure FINRA advertising compliance

Creating compelling creative content is your strength, and Patrina is here to streamline and speed up your approval and distribution process while ensuring strict compliance with FINRA advertising rules. Furthermore, we’ll assist you in archiving all your marketing materials in strict accordance with SEC 17(a)-4 guidelines.

With Patrina, it’s as straightforward as it gets.

Point. Click. Compliance; Patrina’s that simple.

The regulatory landscape can evolve, and compliance requirements may shift. But Patrina ensures you proactively stay up-to-date, implement necessary changes, and demonstrate your commitment to maintaining ethical and compliant advertising practices.

Just a few clicks, and you’re on the path to compliance and peace of mind.

So, when the FINRA advertising regulators call, will you be ready?

Ensuring Compliance with FINRA Advertising Regulations

When the FINRA advertising regulators come calling, preparation is key to maintaining a successful and compliant presence in the financial industry.

Patrina ensures that your advertising materials adhere to FINRA guidelines is not just about avoiding penalties—it’s about building trust with your clients and prospects.

Be ready for a potential inquiry or review by FINRA’s advertising regulators. Patrina helps you stay diligent in your advertising practices including thorough compliance checks for all promotional materials, from website content and social media posts to brochures and print advertisements.

Click here to schedule your Patrina demo or call +1.212.233.1155 today and we’ll help you do more, spend less, and reduce risk!

What is FINRA Rule 2210?

FINRA Rule 2210, known as the "Communications with the Public" rule, is a pivotal regulation in the U.S. securities industry. It governs how broker-dealers communicate with the public, ensuring fairness and accuracy. Key aspects include the review and approval of public communications, emphasizing fair and balanced content, specifying content requirements, requiring principal review for some materials, and mandating robust recordkeeping. FINRA enforces these rules, safeguarding investors by promoting ethical communication practices among broker-dealers, thus upholding market integrity.

What happens one doesn't follow FINRA regulations?

Failure to follow FINRA regulations can result in a range of consequences, including fines, disciplinary actions, suspension or expulsion from the industry, and damage to a firm's reputation. These regulations are in place to protect investors and maintain market integrity, so non-compliance can lead to legal and financial repercussions, impacting both individuals and firms in the financial industry.

What are the challenges of meeting email requirements for FINRA compliance?

Meeting email requirements for FINRA compliance poses several challenges for financial firms. First and foremost is the need to retain and archive all email communications, which can be an enormous data management task. Ensuring that emails are stored securely, searchable, and accessible for the required retention periods is crucial.

Monitoring and supervising email content to ensure it complies with FINRA regulations is another significant challenge. This involves reviewing a high volume of emails for potential violations, such as improper marketing claims or undisclosed conflicts of interest.

Another ones is that encryption and data security measures must be implemented to protect sensitive client information, adding complexity to email systems.

Plus keeping up with evolving FINRA regulations and adapting email policies and procedures accordingly can be demanding.

Addressing these challenges often requires investing in advanced email archiving and surveillance technology, implementing robust compliance policies, and providing ongoing training to staff. The cost and effort are necessary to mitigate regulatory risks and maintain trust in the financial industry.

What security solutions does FINRA compliance include?

Security solutions for FINRA compliance typically include encryption, access controls, and data loss prevention measures to protect sensitive information. Additionally, comprehensive email archiving systems ensure proper retention and retrieval of communications. Monitoring and surveillance tools help detect and prevent non-compliant activities. Regular security assessments, employee training, and incident response plans are vital. Many firms also invest in cybersecurity measures to safeguard against data breaches. A multi-layered security approach is essential to meet FINRA's stringent compliance requirements and protect both client data and the firm's reputation.

What are the fines for FINRA compliance failures?

Fines for FINRA compliance failures can range from thousands to millions of dollars, depending on the severity and frequency of violations. Common infractions include improper record-keeping, inadequate supervision, and misleading communications. Firms and individuals may face monetary penalties, regulatory censures, suspension, or even expulsion from the securities industry. These fines are imposed to uphold market integrity, protect investors, and ensure adherence to FINRA's rules and regulations.