COMPLAINTS MODULE SIMPLIFIES FINRA RULE 4530(a) COMPLIANCE

You’ve got 30 days to come clean. FINRA Rule 4530(a) demands Broker-Dealers report violations of or complaints regarding violations of any financial- or investment-related laws, rules or regulations within 30 calendar days. That’s 30 calendar days to report any violations by or complaints about the firm and/or any associated individual. And the clock starts ticking as soon as the firm learns, or should have learned of the violation/complaint’s existence.

FINRA wants more

Beyond the 30-calendar day reporting requirement, FINRA Rule 4530(d) requires delivery of quarterly statistical and summary data regarding any written customer complaints. FINRA takes customer complaints very seriously, and so should you.

What you don’t know really can cost you

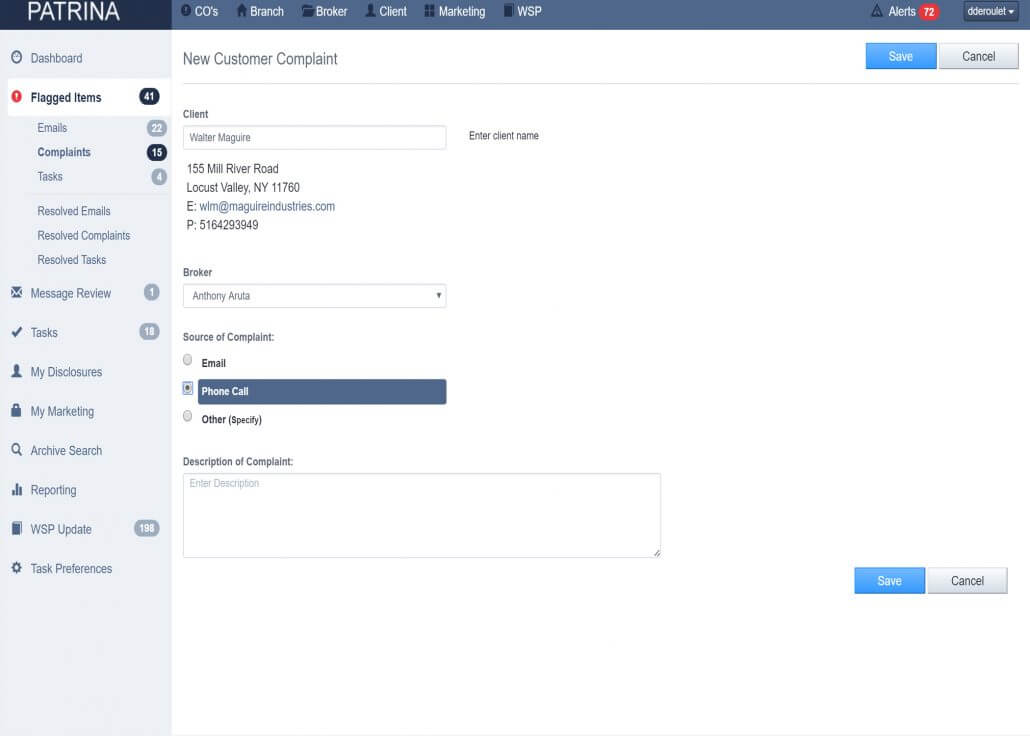

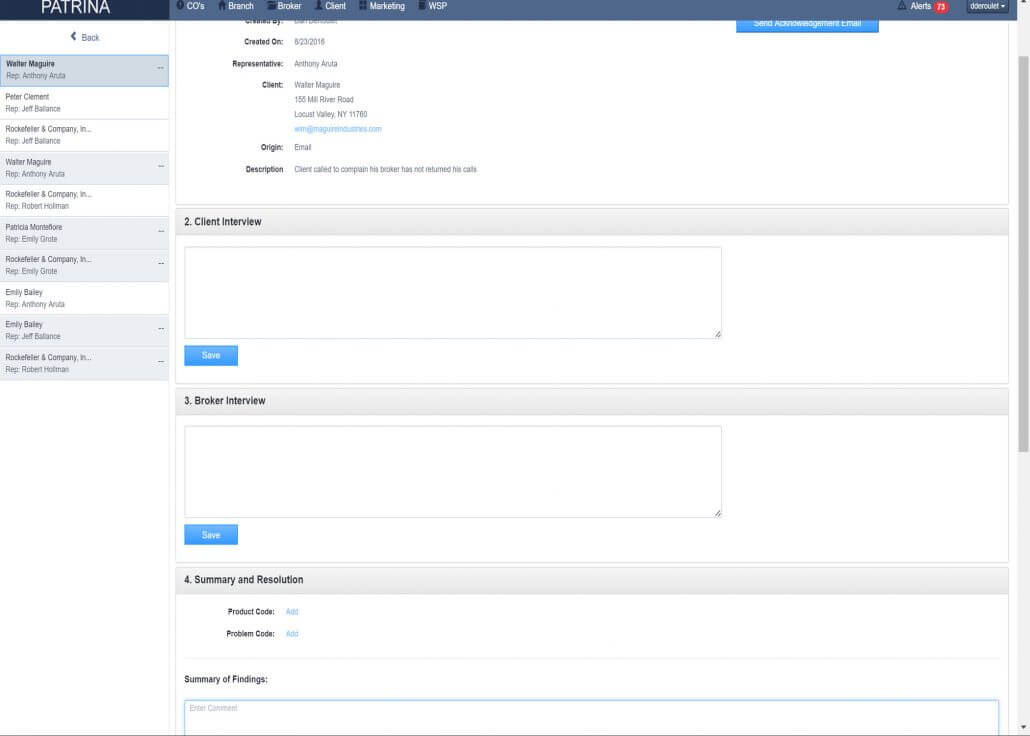

One of 8 powerful modules built on the industry’s easiest-to-use interface, Patrina’s Complaints Module streamlines the collection and reporting process. Identification, confirmation, reporting, investigation, tracking, and remediation are easier from a single Patrina dashboard — regardless of whether you are a one-branch shop or a multinational.

Protect your customers. Protect your firm.

Patrina’s Complaints Module built-in workflows permit you to easily and accurately:

- Funnel complaints to appropriate members for follow-up and investigation;

- Generate customizable customer/internal complaint reports and email acknowledgements to reporting parties;

- Conduct, track, and store interviews and all relevant data in accordance with 17a-(4) requirements;

- Connect appropriate product and problem codes to each complaint;

Best yet, because the Patrina Complaints Module is part of the Patrina Compliance Suite, it integrates smoothly into Branch Risk Profile and Employee Heightened Supervision tools.

Patrina’s that simple

Point. Click. Compliance..

So, when the regulators call, will you be ready?

Click here to schedule your Patrina demo or call +1.212.233.1155 today and we’ll help you do more, spend less, and reduce risk!